Donald Trump's fortress economy is starting to hurt America (Economist) [View all]

https://archive.md/MOxxV#selection-1189.0-1189.59

https://www.economist.com/leaders/2025/10/09/donald-trumps-fortress-economy-is-starting-to-hurt-america

The pain from trade and immigration restrictions cannot be postponed forever

Brick by brick, President Donald Trump is building a wall around the world’s largest economy. As America’s tariff barriers on everyone else have gone up, so has the drawbridge, making it harder for migrants to enter the country. The president wants to turn America into a fortress that keeps out foreign incursions. In fact, he is cutting America off from the very goods and talent that helped make its economy the envy of the world. Already the damage is starting to show; once wreaked, it will not easily be reversed.

That is not how investors see it. In the six months since “Liberation Day”, when Mr Trump slapped tariffs on America’s trading partners, financial markets have swung from panic to euphoria. Elsewhere the picture is mixed. Inflation has risen only a little, as America’s importing businesses have absorbed much of the tariff pain. Although employment has stagnated as migration flows have stopped, America’s economy will probably grow by 1.5-2% in 2025.

Some of the explanation for this resilience is that average tariffs are not as high as was feared, in part because of rollbacks and in part because trade flows are adapting fast. In April analysts were warning of America’s average tariff rate reaching 28%. By August, however, customs revenue raised at the border pointed to a rate of only 11%. It also helps that few countries other than China have retaliated at scale against American duties. Big economies including Britain, Japan and the European Union have struck deals that reduce Mr Trump’s proposed tariffs, without levying their own.

The president is fortunate, too, that America is in the middle of an astonishing stockmarket boom, fuelled by optimism about artificial intelligence (ai). Since a trough in April, the S&P 500 has risen by 40%; valuations now exceed 40 times cyclically adjusted earnings, not far off the record set during the dotcom years. Wealthier investors are in turn spending more and propping up growth.

Meanwhile at Business Insider:

People are chasing AI stocks like 'dogs chase cars' — and a crash looks certain, veteran investor Bill Smead says

https://www.businessinsider.com/ai-stocks-bubble-crash-smead-market-outlook-nvidia-openai-tech-2025-9?op=1

This is, from a fundamental standpoint, identical to all the past major manias," Smead said. "We're bumping up against history real hard now."

Smead said the problem isn't whether AI companies realize the technology's potential benefits, but that "whatever success they might have has already been massively overcapitalized."

He said that "when this thing breaks," people will only be willing to buy AI stocks at a fraction of their current price.

Oracle stock jumped 40% in a day earlier this month after it forecast rapid revenue growth in its cloud infrastructure business, which caters to AI companies such as OpenAI.

Smead holds AirBasketball to be used in the new Allen Iverson (AI) Basketball League.

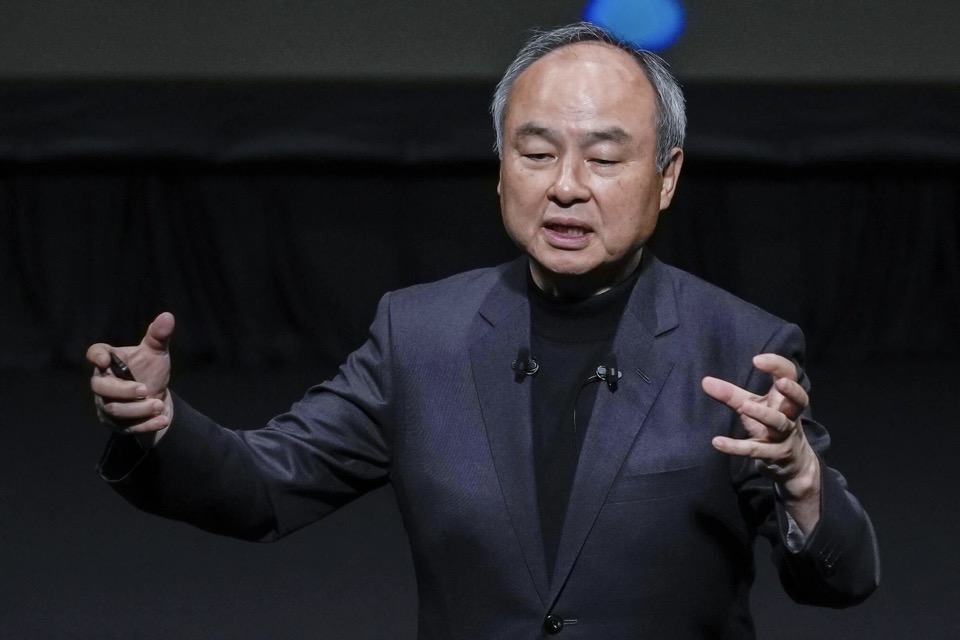

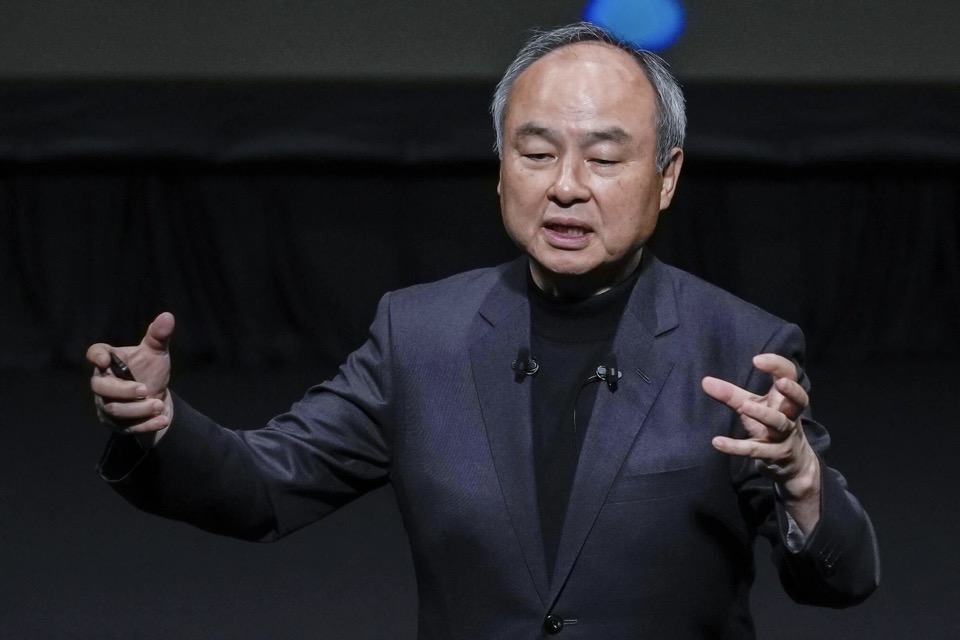

Softbank leader Masayoshi Son holds an Air AIcordion, set to revolutionize music entirely.

Softbank leader Masayoshi Son holds an Air AIcordion, set to revolutionize music entirely.

Party like it's 1965

Party like it's 1965

Look out

For the trader

Make way for the fool hearted clown

Look out

For the trader

He's gonna build you up

Just to let you down