In 2020, as the pandemic took hold, U.S. health insurance companies declared they would cover 100 percent of the costs for covid treatment, waiving co-pays and expensive deductibles for hospital stays that frequently range into the hundreds of thousands of dollars.

But this year, most insurers have reinstated co-pays and deductibles for covid patients, in many cases even before vaccines became widely available. The companies imposed the costs as industry profits remained strong or grew in 2020, with insurers paying out less to cover elective procedures that hospitals suspended during the crisis.

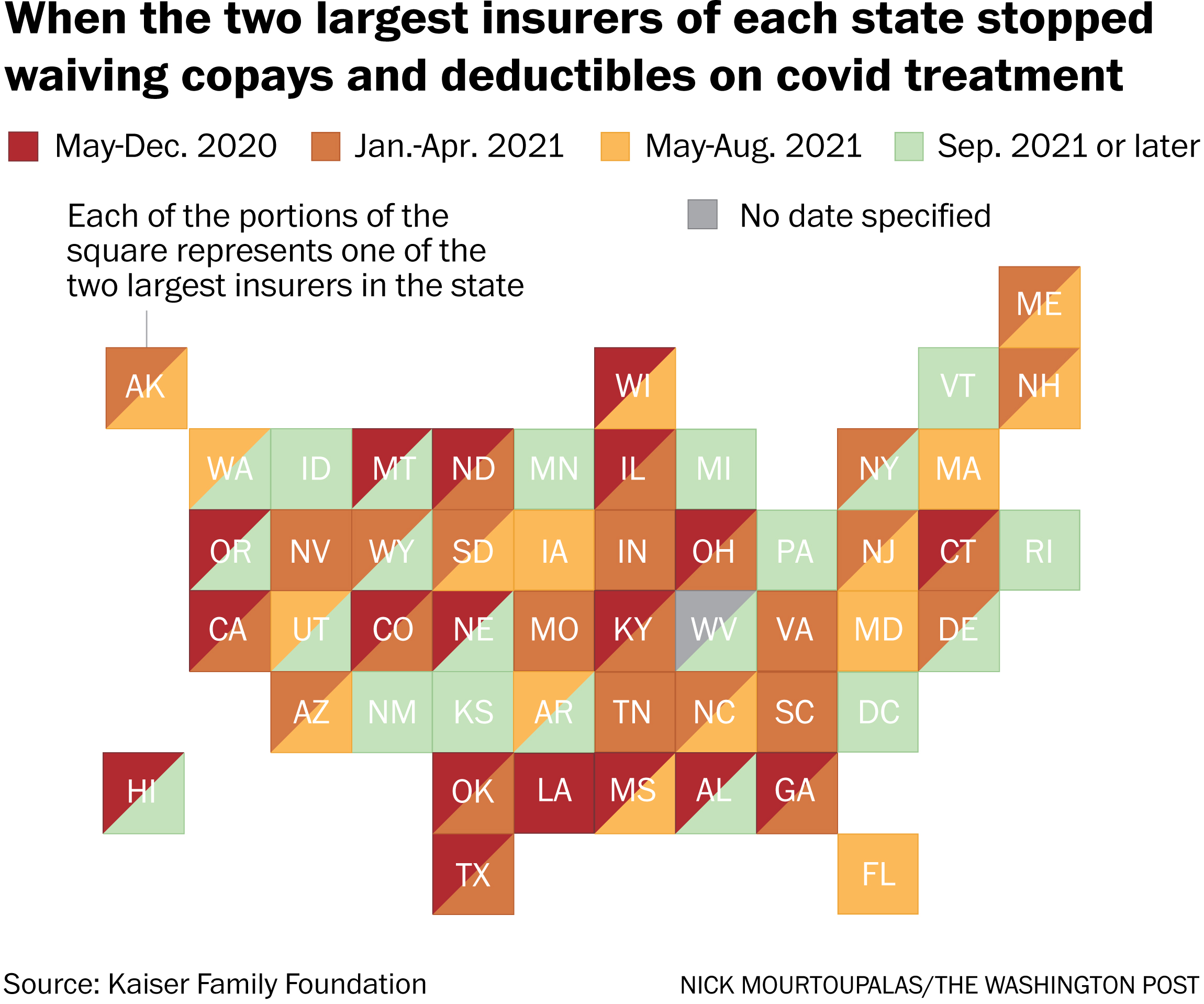

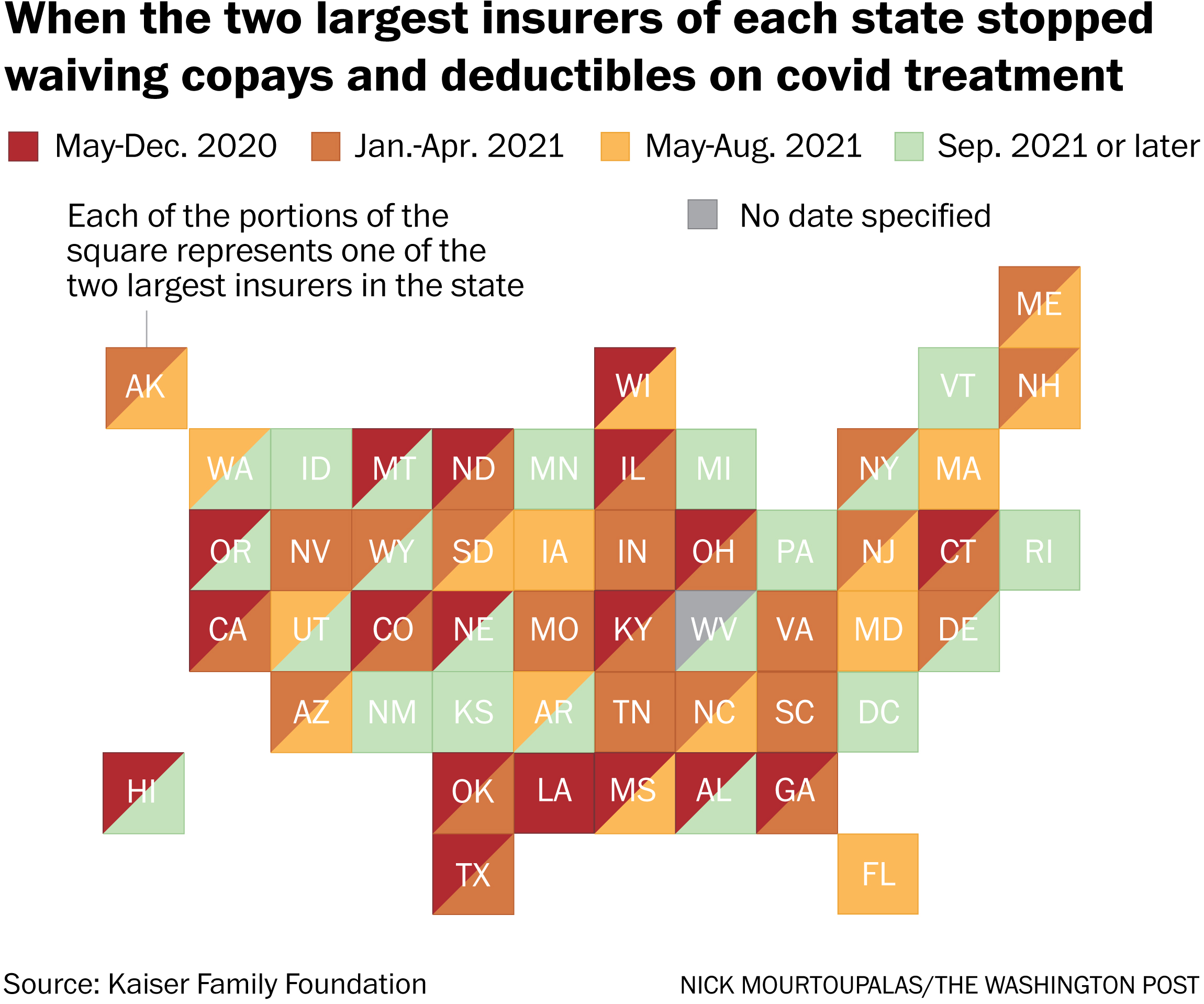

Now the financial burden of covid is falling unevenly on patients across the country, varying widely by health-care plan and geography, according to a survey of the two largest health plans in every state by the nonprofit and nonpartisan Kaiser Family Foundation.

https://www.washingtonpost.com/wp-apps/imrs.php?src=

&w=916

.....“There was no federal mandate for insurers to cover all the costs for covid treatment. Insurers were doing it voluntarily,” said Krutika Amin, a Kaiser Family Foundation associate director who researchers health insurance practices.

Last year, according to the Kaiser Family Foundation, 88 percent of people covered by private insurance had their co-pays and deductibles for covid treatment waived. By August 2021, only 28 percent of the two largest plans in each state and D.C. still had the waivers in place, and another 10 percent planned to phase them out by the end of October, the Kaiser survey found. Its survey this year of employer-sponsored plans reflected similar patterns.

“For some people, deductibles can be over $8,000 for a hospital stay,” Amin said. “It will really depend on what plan they have.”

&w=916

&w=916