General Discussion

Related: Editorials & Other Articles, Issue Forums, Alliance Forums, Region ForumsAs I understand it, here's a very simplistic explanation of what happened with Silicon Valley Bank.

Last edited Sun Mar 12, 2023, 01:01 PM - Edit history (2)

Large depositors place their money into accounts at Silicon Valley Bank (SVB).

Banks want to earn a return on that deposited money, instead of letting it sit there, earning nothing for them.

Banks invest deposited amounts into some type of financial vehicle in order to get a return on the deposited funds for themselves. For example: money market funds, CD's, mortgage backed securities, maybe a small portion into the stock market, etc.

Risk management at a bank would perform detailed analyses to make sure that the investments the bank made with deposited money would not hamper the ability for bank customers to withdraw their funds. This analysis would include balancing the risks inherent in whatever the bank invested the depositor's funds in . The bank would need to make worse case assumptions to ensure that they are liquid enough to provide the cash to customers in cases where, for example, withdrawals would for some reason increase by X%. In other words, the bank would have to be very conservative and assume an increase in normal withdrawal rates. They would have to factor in a "buffer" so to speak, should withdrawals increase. This means that a particular percentage of SVB's investments would have to remain very liquid (quickly and easily converted to cash).

Before Trump took office, certain banks holding $X in deposits were subject to "stress tests" by federal regulators to ensure the banks were liquid enough to provide depositors their money should the amount of withdrawals increase above a "normal" amount.

Trump did away with the regulations that required certain banks to be stress tested to ensure that their investments, using depositor's money, were not subject to unusual risk.

SBV over-weighted the amount of depositor's funds that were used to buy long-dated government bonds.

Long dated government bonds are subject to a particular type of risk known as "interest rate risk".

Here's the mechanics of this risk:

Bank buys a government bond with depositor's money in order to earn a return on that money for themselves. The bond has a par value (face value) of $1,000, and since the bank was purchasing these bonds when interest rates were low, the bond pays 1% interest per annum (I'm just making up numbers here for this example).

The fed increases interest rates in order to try to slow down inflation. This means that all interest rates rise. Credit card interest, savings deposit interest, money market interest, mortgage interest, etc.

A large depositor who placed cash into an SVB account comes in and wants to withdraw $200 million. Because the bank placed most of their deposited funds into government bonds (they over-weighted their investments in bonds and did not hold enough deposits in more liquid investments like cash or money market funds), the bank does not immediately have the cash to give to the person making the large withdrawal.

To get the $200 million to the person withdrawing, the bank has to go out and sell $200 million of the bonds they bought.

However, now they have to find a buyer for the bonds on the open bond market. The bonds are paying only 1% interest since the bank bought them when interest rates were low. The person who is buying the bonds from the bank is going to want to earn more than 1% interest, because interest rates are higher now, and more than 1% can be made in other investments by the bond purchaser.

So in order to make a percentage greater than 1%, the purchaser of the bonds will not buy the bonds for what the bank paid for them ($200 million). The purchaser of the bonds will pay less than the face value of the bonds, so his return will be comparable to that of which could be made in other investments. Therefore, the bank loses money on the bonds that they sell in order to cover the withdrawal.

Selling bonds takes a bit of time, which means that if the bank is over-weighted in government bonds, and don't have enough liquid assets to cover the withdrawal, the the person trying to withdraw their money may have to wait until the bank sells some bonds for cash in order to give the money back to the depositor.

Once this happens a few times, word gets out, and more and more people start withdrawing their money from the bank out of concern for the banks stability.

Summary:

Trump eliminated regulations for certain banks to be stress tested in order to ensure that they are liquid enough to provide customers with their funds should the amount of withdrawals increase above a normal amount.

ggma

(711 posts)This gives me a much better understanding, LuckyCharms. Well written.

gg

lapfog_1

(31,347 posts)Add to that the greed of the bankers... they purchased long term bonds back in the near 0% Fed rate era (COVID) and did not anticipate that the FED would raise the interest rates as fast as they have.

The run on the bank may have been intentional... to cause the bank failure and possibly to cause other secondary effect to the overall markets... and blame everything on Biden and the Dems.

Who would do such a thing?

https://www.bloomberg.com/news/articles/2023-03-11/thiel-s-founders-fund-withdrew-millions-from-silicon-valley-bank

And he didn't lose even a penny of his money doing this.

Pure speculation on my part but it is curious.

Fiendish Thingy

(21,111 posts)Johnny2X2X

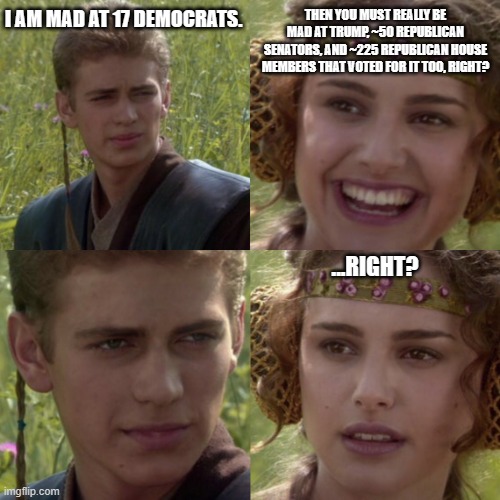

(23,522 posts)Trump with support if 100% of Republicans and 35% of Democrats in the Senate repealed these laws that would have protected us. The majority of Democrats in the House and Senate tried to stop this. 65% of Dems in the Senate and 83% in the House tried to stop this.

Blame should be proportional and most Dems tried to stop this while all Republicans supported this.

Fiendish Thingy

(21,111 posts)And not downplay or ignore those who are Democrats.

Johnny2X2X

(23,522 posts)Namely 158 Democrats and 1 Republican in the House and 31 Democrats and 0 Republicans in the Senate. This was written and championed by the GOP, Dems tried to stop it. A minority of Dems went along and deserve some blame, but this was a Republican idea and law.

Justice matters.

(9,021 posts)to both the Fascists and the Democrats who voted for that scam crap.

Public financing of elections is badly needed. They don't read the bills, they fundraise more than they study the potential impacts of their votes.

Something's gotta change but with 50 divided states, I guess it's too much to ask...

Stargazer99

(3,351 posts)what about its...re how many Demos tried to stop Trumps stupidity

Johnny2X2X

(23,522 posts)If Dems passed some law that backfired Dems would get blamed for the law they wrote, they passed, and a Dem President signed into law even if a hand full of Republicans went along in the Senate to break a fillabuster. The roll back of Dodd-Frank was a GOP idea, it was written by Republicans, championed by Republicans, and signed into law by Republicans. They got enough Dems in the Senate to go along to break a fillabuster, but not until after those Dems got some concessions to protect consumers. Republicans would have found a way to pass it regardless of Dem support. Deregulating banks was one of the GOP's main issues.

maxrandb

(16,934 posts)At least until one of the parties isn't calling for goulags and authoritarian rule.

Because one of the parties has gone full-tilt, 100% foot on the gas fascist.

Maybe we should concentrate on ensuring we defeat the treasonous bastards party FIRST.

There will be plenty of time to hold that minority number of Democrats accountable, after we rescue Democracy.

DoBotherMe

(2,350 posts)Fiendish Thingy

(21,111 posts)This won’t go on my permanent record, will it?

Put me down for striving and working to elect the best, least corruptible Democrats to support Biden’s agenda and work for the people, not the corporations.

Wonder no more.

wnylib

(25,345 posts)krkaufman

(13,957 posts)Fair enough, but your comment mentioned only Trump and Democrats.

W_HAMILTON

(9,734 posts)

Fiendish Thingy

(21,111 posts)So, rather than express my outrage at them daily, for my sanity and health, I choose to vent on those thankfully less frequent occasions when Democrats don’t act like Democrats.

W_HAMILTON

(9,734 posts)Mmhmm.

Fiendish Thingy

(21,111 posts)Just got a fundraising email from him blasting Sinema for voting yes on the banking bill, while noting that he voted no.

W_HAMILTON

(9,734 posts)Or is he slamming the now Independent Sinema for Sinema's actions?

But your answer that you find it healthier for you to criticize Democrats rather than Republicans was pretty much all I needed to hear -- that comment speaks for itself.

Fiendish Thingy

(21,111 posts)To you, that is.

betsuni

(28,485 posts)Even when no Democrats vote for something they too often get blamed. I can image the glee at finding a small minority of Democrats voting for something bad. BOTH SIDES DANCE PARTY!

progressoid

(52,192 posts)in2herbs

(4,007 posts)But I have a list of Republicans who did:

1. Every single fucking one of then in the Senate!

2. Every single fucking one of them in the House save for 1 guy from NC.

3. The Orange Menace who signed it into law.

So yeah, hold that minority of Dems accountable, but the blame for this resides primarily with 1 party.

W_HAMILTON

(9,734 posts)If a few of our, umm, allies want to grab their pitchforks, start with poking the 99% of Republicans that were directly responsible for this.

progressoid

(52,192 posts)Bennet (D-CO)

Carper (D-DE)

Coons (D-DE)

Donnelly (D-IN)

Hassan (D-NH)

Heitkamp (D-ND)

Jones (D-AL)

Kaine (D-VA)

King (I-ME)

Manchin (D-WV)

McCaskill (D-MO)

Nelson (D-FL)

Peters (D-MI)

Shaheen (D-NH)

Stabenow (D-MI)

Tester (D-MT)

Warner (D-VA)

https://clerk.house.gov/Votes/2018216

Bera Democratic California YEA

Bishop Democratic Georgia YEA

Blunt Rochester Democratic Delaware YEA

Carson Democratic Indiana YEA

Correa Democratic California YEA

Costa Democratic California YEA

Cuellar Democratic Texas YEA

Davis, Danny Democratic Illinois YEA

Delaney Democratic Maryland YEA

Foster Democratic Illinois YEA

Gonzalez Democratic Texas YEA

Gottheimer Democratic New Jersey YEA

Hastings Democratic Florida YEA

Himes Democratic Connecticut YEA

Kind Democratic Wisconsin YEA

Kuster Democratic New Hampshire YEA

Larsen Democratic Washington YEA

Lawson Democratic Florida YEA

Maloney, Sean Democratic New York YEA

Murphy Democratic Florida YEA

Nolan Democratic Minnesota YEA

O'Halleran Democratic Arizona YEA

Peters Democratic California YEA

Peterson Democratic Minnesota YEA

Rice Democratic New York YEA

Schneider Democratic Illinois YEA

Schrader Democratic Oregon YEA

Scott, David Democratic Georgia YEA

Sewell Democratic Alabama YEA

Sinema Democratic Arizona YEA

Suozzi Democratic New York YEA

Veasey Democratic Texas YEA

Vela Democratic Texas YEA

Delphinus

(12,455 posts)usonian

(21,822 posts)Federalist Reserve?

SVB did not hedge rate increases.

Gory details referenced in a long and detailed tweet stream here.

https://democraticunderground.com/100217719896

Thanks for the simpler explanation.

OH, BY THE WAY: Peter Theil's Founders Fund got the hell out just before the debacle.

https://www.bloomberg.com/news/articles/2023-03-11/thiel-s-founders-fund-withdrew-millions-from-silicon-valley-bank

By Lizette Chapman

March 10, 2023 at 4:52 PM PST

Founders Fund withdrew millions from SVB, said the person, who asked not to be identified discussing private information. It joined other venture funds that took dramatic steps to limit exposure to the now-failed financial institution. Founders Fund also advised its portfolio companies that there was no downside to moving their money away from SVB, even if the risk was low.

Founders Fund acted in other ways to move its business away from SVB. On Thursday, as the bank was beginning to unravel, the firm started what’s known as a capital call. That’s a run-of-the-mill activity in the venture capital world, in which a VC firm asks its investors, or limited partners, to send it money in order to make investments in startups — the core function of most VC firms. It began by asking those backers to transfer the funds to accounts at SVB, as it has done for years, the person said

Quickly, Founders Fund asked its investors to transfer the money to other banks instead.

Lonestarblue

(13,016 posts)Biden should have replaced Powell the minute he had a chance. If Biden has a blind spot, it’s that he still thinks there are some decent Republicans who want what’s good for the country instead of whatever will help them win.

sprinkleeninow

(21,764 posts)ashredux

(2,789 posts)Just DUMB…flat out dumb

Fiendish Thingy

(21,111 posts)The Fed has telegraphed their hikes for over a year.

dalton99a

(90,885 posts)ashredux

(2,789 posts)for you are correct, and even the uneducated saw that

uponit7771

(93,325 posts)flashman13

(1,673 posts)No one has accused SVB of holding too few liquid assets to cover normal withdrawals or even above normal withdrawals. What happened was a few influential financial investors (hedge funders) publicly advised their clients and associates to pull their deposits from SVB. That advice undermined general confidence in SVB and by doing so caused a classic run where everyone wants their money today. Hence, SVB was forced to sell bonds in an attempt to hold off failure which only undermined confidence further.

The real culprit here is the Federal Reserve driving interest rates to unheard of lows and then maintaining those rates for an extended period of time. It should be noted that even with those low rates GDP growth was sluggish. What do you think will be the repercussions of rapidly raising those rates?

Fiendish Thingy

(21,111 posts)But COVID and the war in Ukraine were major uncertainties to contend with. Consequently, Powell had to hike more frequently and in bigger increments. It’s the only tool he has.

Congress had the power to intervene by rescinding Trump tax cuts and enacting Biden’s billionaire tax, but couldn’t/wouldn’t act.

ashredux

(2,789 posts)Also, the ability to regulate midsize banks was cut under Trump. The banking regulators were not able to continue with the stress test did do for mid size banks. If anyone is the culprit, other than the bank management, it was President Trump, who signaled the deregulations into law.

flashman13

(1,673 posts)the Federal Reserve is responsible for the systemic problems created by catering to Wall Street, keeping interest rates unrealistically low in order to boost stock prices (also low rates encourage investment in poor quality projects). Now the Fed is getting it all wrong again by trying to fight inflation, which is being caused by a large variety of factors, none of which are low interest rates, by rapidly raising rates. They never should have allowed interest rates to sink to such lows and then hold hold those rates there for far too long. In 2021 SVB's investment strategy was conservative.

I hope I am wrong, but the SVB debacle could occur on a much larger scale because the balance sheets of many other institutions look the same as SVB.

In the near term it all comes down to the level of confidence in the system. If panic sets in, it's Katie bar the door. We'll know soon enough when Asian financial markets weigh in.

uponit7771

(93,325 posts)... too long waiting on maturity.

If there any other banks that stupid to hold on to that position for that long they all need to go to jail

paleotn

(21,057 posts)The thing about bank runs, they become self fulfilling prophecies.

flashman13

(1,673 posts)Warpy

(114,089 posts)You have a parent company owning a niche bank. Nothing wrong there until the parent company got into the crypto craze just a little too late and started losing its shirt. It needed to increase the cash flow from its other holdings so there was pressure on the niche bank to make higher risk loans at higher interest rates. When those higher risk loans defaulted, there went the bank.

How was the bank allowed to take on that kind of risk? Deregulation during TFG's hideous reign.

Backseat Driver

(4,671 posts)stock/bond investment level(s) or help cause it in some way? Dated July 20, 2021

https://www.svb.com/news/company-news/nasdaq-svb-citi-goldman-sachs-and-morgan-stanley-launch-new-platform-for-trading-private-company-stock2

Backseat Driver

(4,671 posts)APR savings accounts one can also save and grow faster via using the phone app--more functionality w/iOS device--like too good to be true likely is, LOL? Like Little Shop of (tax--investment) Horrors???

Paper Roses

(7,584 posts)brooklynite

(96,882 posts)Bank invest to make a return AND to pay interest on deposits to attract customers.

The Treasuries they invested in are reliable but generate low interest. In an inflationary period, the bank has to increase the interest rates they offer depositors, creating a gap they can’t cover when withdrawals are made.

LuckyCharms

(20,943 posts)flashman13

(1,673 posts)mainer

(12,458 posts)They didn’t gamble with risky investments, and as a result suffered when interest rates shot up.

It’s scary that all it takes is a few influential (and maybe evil) big mouths to induce panic and bring down a bank.

ashredux

(2,789 posts)mainer

(12,458 posts)Is that what it comes down to? I think there’s a big difference.

(Rather than making crazy investments like crypto)

ashredux

(2,789 posts)LuckyCharms

(20,943 posts)They were over-weight in investments that carried substantial interest rate risk.

Also, this was not caught upon inspection by the feds, since regulation requirements were loosened by the former administration.

Now, the FDIC has moved in, and depositors are only covered with FDIC guarantees up to $250,000 per each depository account.

93% of deposited dollars in SVB are over $250,000 per account. That means that most depositors had well over the FDIC insured amount, and may be left holding the bag for at least a portion of the overage, depending upon the final disposition of the bank's assets and liabilities.

uponit7771

(93,325 posts)jaxexpat

(7,794 posts)It works until someone in a position of power convinces everyone they're psychic. Identify that guy and you've solved the whole crime.

jmbar2

(7,390 posts)I've been watching the crypto market throughout this debacle. Don't own it myself, but it gives a temperature reading when markets are closed.

WSJ just posted that SVB is to be auctioned off. Crypto is soaring on that news. I guess the markets like it.

ashredux

(2,789 posts)peppertree

(22,976 posts)The county treasurer, Bob Citron, invested heavily in government bonds in '93 - when their value was going up thanks to Clinton's budget deficit reductions.

And they were having a ball - until Greenspin started raising rates in '94 like a maniac (or, rather, like the GOP hack he was).

The bonds fell in price - just enough to make Orange County (which was already reeling from the early '90s recession) insolvent.

They recovered quickly - but, leave it to some banking know-it-all to think they, well, know it all.

My heart goes out to the affected depositors - which you can bet will be most of them. May they recover as much as possible.

tornado34jh

(1,513 posts)But I will say a couple of points, though. First, I think many have this tendency that a bank, company, or something like that is too big to fail, and we often try to bail them out even though I don't think they should be bailed out due to their poor decision making and greed. Second, this isn't anything new. Biden, when we has VP with Obama, has seen a lot of banks fail and all that. But this practice of assuming a bank will not fail goes back a while, before even Obama was in office. A lot of it is due to unstable bubbles. Basically, they are riding on this bubble, but it only goes so far, and when that pops, they don't have the redundancy/contingency when things go south.

ashredux

(2,789 posts)tornado34jh

(1,513 posts)That said, however, a lot of these companies don't do the best financial practices, and again, markets change over time. But I think even with the regulations, they were playing too fast and loose and it came back to bite them in the back.

ashredux

(2,789 posts)mainer

(12,458 posts)Sorry for not understanding this subject, but it sounds like the money hasn’t vanished, it’s just sitting in a place that’s safe but not easily liquid, so depositors should be able to get it eventually?

LuckyCharms

(20,943 posts)the bonds would have to be sold at a discount in order to cover the original deposits. That's because in this high interest rate environment, they need to be able to find a buyer for the bonds. A buyer will pay less for a low interest rate bond so his percentage yield will be higher.

So in essence, the difference between what the bank paid for the bonds and what they sold the bonds for is lost, disappeared.

A HERETIC I AM

(24,829 posts)1st, the market for US Treasuries is wide, extremely deep, VERY liquid and worldwide. We are talking literally TRILLIONS of dollars worth. The idea that this bank has to "find a buyer" is somewhat misleading, as one single pass across a bond desk at any brokerage in the world would find a willing buyer for virtually any amount of any series in a matter of seconds.

2nd, you have insinuated a few times that these bonds are somewhat less than completely liquid, and that is simply not the case, for the reason I stated above. US Treasuries settle Same Day, as opposed to the traditional "Trade Plus 3" settlement of most other securities. If you put up the $200 million figure (a drop in the bucket compared to the overall size of the market) you have used numerous times for sale in the morning, by the middle of the afternoon your account would be credited with the cash. It isn't as if you would have to wait days and days or even a full 24 hour period. A number of the articles that have been linked on this subject indicate the bank sold some $21Bn of their bond portfolio, a large sum to be sure, but again, not much compared to the overall market for this paper.

Your assertion that they have sold these bonds at a loss is correct, but since these bonds are sold "Over The Counter" and on a Bid/Ask basis, that market takes into account the time to maturity, coupon, current yield trends on similar bonds sold and the direction the bond market is heading (a rally or a selloff), so a bond with a 2% coupon as an example selling into a 2.5% market would absolutely sell at a discount to par.

It is also important to keep in mind that the Yield is typically only realized if the bond is held to maturity and then redeemed by the Treasury (there are various yield calculations, of course; Running Yield, Nominal Yield, Yield to Maturity (YTM), Tax-Equivalent Yield (TEY), Yield to Call (YTC), Yield to Worst (YTW) etc.) . If you buy a 2% coupon at a discount on Jan 1, hold it until you receive one of the bi-annual interest payments and then sell, the yield quoted on the day of purchase will not necessarily be what you actually realize on the day you sell.

LuckyCharms

(20,943 posts)The problem is not that the bonds are illiquid...they are very liquid.

I guess by "finding a buyer", I was implying "place an ask in the open market".

So days until settlement would not be the problem, and I may have over emphasized that.

The problem is that they are selling the bonds at a loss.

With regard to settlement though, individuals and businesses expect to be able to walk into a bank and pull out their money instantaneously. Literally walk up to a teller and ask for their money. And get their money, that very second.

Now, I'm not sure if a one day settlement in actuality affects a delay in receiving funds. I'm not that familiar with the mechanics of settlement.

Regardless, a seed was somehow planted with regard to the fact that bonds had to be sold to pay out a cascading amount of people withdrawing their money. If there was any kind of delay or caveat when a depositor went to get their money, that's going to snowball and cause a run.

I'm also wondering about snippets I am reading that some entity, perhaps a hedge fund, put a bug in the ear of some bank customers that the bank is in trouble, and is taking a huge loss on their bond sales.

ashredux

(2,789 posts)uponit7771

(93,325 posts)mainer

(12,458 posts)True? Hyperbole?

(To be honest, I just earn the money and hand it off to my four different investment advisors. I don’t really understand bonds. But I do practice eggs in different baskets.)

Link to tweet

?s=61&t=cSnkab_GYBjAWds51uZU8Q

LuckyCharms

(20,943 posts)If they do, something is wrong.

And if they have sufficient assets, why is the FDIC involved at this point?

Those would be my initial comments after a cursory look at the tweet.

roamer65

(37,806 posts)William Gustafson

(517 posts)As the Bitcoin debacle crashed the last few months, I would not be surprised that this bank was dallying in pushing customers to bitcoin as a way to do business without being tracked.... The major people using bitcoin are Drug dealers, Weapons dealers and Human Trafficking...with a small amount of people getting into it.... By using Bitcoin, money transfers cannot be traced, which is why these groups us it.... Time will tell as to what caused this collapse of this bank, but I bet Bitcoin crash will be part of it...

lonely bird

(2,585 posts)Fractional reserve banking lends itself by its very nature to instability and susceptibility to bank runs. The entire system is based upon confidence. When confidence comes into question people will try to remove funds. Banks will as the OP notes try to raise funds by selling assets. In the treasuries example there is a huge and liquid market on its facefor the treasuries but counterparties will seek for lack of a better word discounts on purchasing said assets. This applies to all the financial instruments a bank has except cash. These financial instruments only have value because people believe they have value. The value of the assets will continue to decline because the seller must raise cash. Buyers know this and will apply pressure.

orangecrush

(27,105 posts)How very convenient for Russia and China.

DJ Porkchop

(635 posts)

samsingh

(18,196 posts)ecstatic

(34,960 posts)that were purchased and then Silicon Valley Bank can return the money to depositors? And yes, trmp's loosened regulations need to be reversed.